NSE: SBICARD – SBICard is a credit card subsidiary of the State Bank of India. It is one of the chief public sector banks in India. SBICard lists on the National Stock Exchange of India (NSE) with the stock code SBICARD.

As of our knowledge cutoff date of September 2021, SBICard had a market capitalization of approximately INR 96,000 crores, and its stock was trading at around INR 1,180 per share. However, please note that stock prices and other information can fluctuate and may differ at the current date.

Table of Contents

What is NSE: SBICARD?

NSE: SBICARD is a stock listed on the National Stock Exchange of India, representing the State Bank of India’s credit card business. The company offers customers a range of credit cards in India, including travel, shopping, and lifestyle cards. As an investor, you can buy NSE: SBICARD and potentially benefit from the company’s growth and profitability.

How does NSE: SBICARD Work?

NSE: SBICARD is a publicly traded company on the National Stock Exchange of India. As an investor, you can purchase company shares and benefit from their growth and profitability.

The company’s credit card business offers a range of cards to customers in India, including travel, shopping, and lifestyle cards. By investing in NSE: SBICARD, you are essentially buying a stake in the company and can potentially earn returns on your investment through dividends or capital appreciation.

What are the Benefits of Investing in NSE: SBICARD?

Investing in NSE: SBICARD can offer several benefits to investors. Firstly, the company is vital in the Indian credit card market, which expects to grow in the coming years. It means that it is probable for the company to increase its revenue and profitability, which can translate into higher returns for investors.

Additionally, NSE: SBICARD has a track record of paying dividends to its shareholders, which can provide a steady income stream for investors. Finally, investing in NSE: SBICARD can help diversify your portfolio and potentially reduce overall investment risk.

How to Invest in NSE: SBICARD?

Investing in NSE: SBICARD is easy and can be done through various channels. You can invest in NSE: SBICARD through a stockbroker, online trading platform, or mutual fund. Before investing, it’s essential to research and understands the risks and potential recompenses of investing in this company.

Before making investment decisions, consider your investment goals, risk tolerance, and overall portfolio diversification strategy.

To invest in NSE: SBICARD, which represents the stock of SBI Cards and Payment Services Limited, you can follow these general steps:

- Research and gather information: Before investing in any stock, it’s crucial to research and understand the company, its financials, market position, growth prospects, and any relevant news or updates. Review the annual reports, financial statements, and other available resources to make an informed decision.

- Choose a brokerage account: To buy and sell stocks on the National Stock Exchange (NSE) in India, you’ll need a brokerage account. Select a reputable brokerage firm that suits your investment needs, offers NSE trading services, and provides a user-friendly trading platform.

- Open a brokerage account: Follow the procedures outlined by the chosen brokerage firm to open an account. This typically involves submitting required documents such as identity proof, address proof, and bank account details. Complete any additional paperwork or online registration as instructed by the broker.

- Fund your account: After opening the brokerage account, you’ll need to transfer funds into it. This can usually be done through online banking, NEFT/RTGS transfers, or other accepted payment methods provided by the broker.

- Place an order: Once your brokerage account is funded, access the trading platform provided by the broker. Search for the stock symbol “SBICARD” or “SBICARDS” on the platform and select it. Specify the type of order you want to place, such as market order or limit order, and the quantity of shares you wish to purchase.

- Monitor and manage your investment: After buying the SBICARD stock, monitor its performance regularly. Stay informed about the company’s updates, financial results, and market trends. Based on your investment goals and risk tolerance, you may decide to hold the stock for the long term or sell it at a favorable price.

It’s worth noting that investing in the stock market involves risks, and it’s advisable to consult with a financial advisor or do thorough research before making any investment decisions.

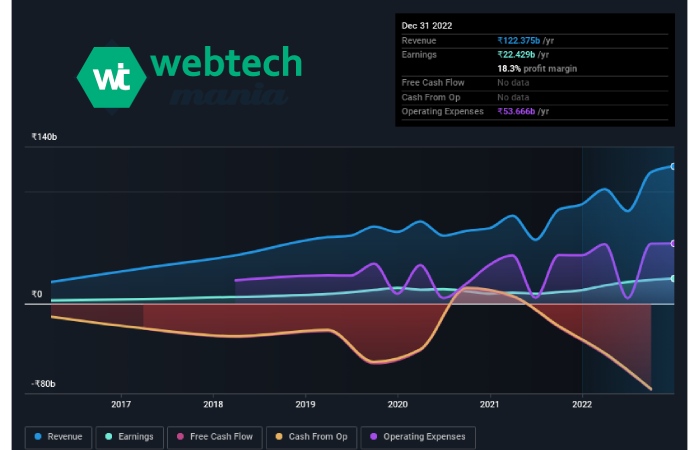

Now there are some of the Key Financial Highlights for SBICard:

In terms of financial performance, SBI Card has shown steady growth in recent years, with increasing revenue and profit margins. The company has also been growing it is product portfolio and customer base, focusing on offering advanced products and services to its customers.

- Revenue: In the financial year 2020-21, SBICard reported a total income of INR 10,719 crores, representing a year-over-year growth of 3.8%.

- SBICard reported a net profit of INR 1,257 crores in the financial year 2020-21, representing a year-over-year growth of 12.6%.

- Assets: As of March 31, 2021, SBICard’s total assets stood at INR 34,035 crores.

- Non-Performing Assets (NPAs): SBICard’s gross non-performing assets (NPAs) as per a percentage of total advances stood at 4.51% as of March 31, 2021. Which is more complicated than the previous year’s figure of 2.47%.

Please note that these financials are subject to change based on the company’s future performance and external factors such as market conditions and economic trends. Additionally, there may be more recent financial information available that I do not have access to.

Investors interested in SBI cards should carefully review the company’s financial statements, annual reports, and other disclosures. To gain an improved understanding of the company’s financial performance and prospects.

Financial analysts and market experts may also provide insights and analysis on SBICARD’s stock performance and prospects on various financial news websites or brokerage platforms.

Suppose you want to diversify your investment portfolio. However, this may be an intelligent choice. This guide indicates the benefits of investing in this stock, including potential returns and risks. Find out how [NSE: SBICARD] can help you achieve your financial goals.

Risks and considerations when investing in NSE: SBICARD.

However, as with any investment, there must be risks and considerations when investing in [NSE: SBICARD]. One risk is the potential for market volatility, which can also cause the value of your investment to fluctuate.

Changes in government regulations or economic conditions can also impact the company’s performance. Therefore, it’s essential to consider these risks carefully and consult with a financial advisor previously making any investment decisions.

Conclusion

SBI Card is a credit card issuer and one of India’s important credit card companies. It is a secondary of the State Bank of India (SBI), India’s largest commercial bank.

SBI Card lists on the National Stock Exchange of India (NSE) with the stock symbol “SBICARD.” As of our knowledge cutoff date of September 2021, the stock price of SBICARD on NSE was around INR 1,130 per share, with a market capitalization of around INR 93,000 crore.

Related searches –

[sbi card share price future prediction]

[nse:sbicard financials]

[sbi card share price target 2025]

[nse:sbicard news]

[sbi cards and payment share price]

[sbi card share price target 2024]

[sbi card share price target 2023]

[sbi card news]